Stipends and reimbursements are two common ways to pay employees back for business-related expenses and offer lifestyle benefits. And so the question becomes, which to offer? What is the right choice for stipends vs. reimbursements?

We often get asked this question when employers are exploring different benefit options for their people. Stipends vs. reimbursements are two different (though not mutually exclusive) concepts. This guide will show you which type of compensation to use and when.

What are stipends and reimbursements, exactly?

First, let’s define stipends and reimbursements.

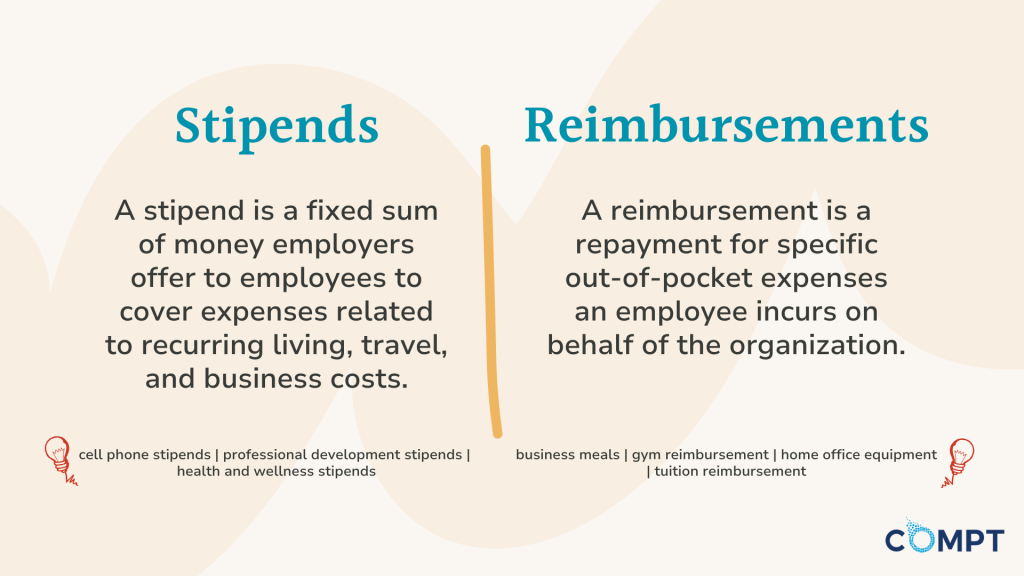

A stipend is a fixed sum of money employers offer to employees to cover expenses related to recurring living, travel, and business costs.

Employers typically disburse stipends through payroll ahead of time on a monthly, quarterly, or annual basis (monthly stipends are the most common). The amount is always the same, no matter the cost of services or materials.

A reimbursement is a repayment for specific out-of-pocket expenses an employee incurs on behalf of the organization.

It’s typically a one-time payment that occurs after an employee has already paid for a product or service. With reimbursements, employers agree ahead of time to cover a portion (or the total amount) of an employee’s purchases – e.g., a plane ticket, home office equipment, or school tuition.

There are two primary ways employers use stipends and reimbursements:

- To offset business expenses – When employees have to spend their own money to perform their job function or conduct business on behalf of the company, the company will reimburse them and deduct the amount on an expense report. 11 states, D.C., and Seattle, WA legally require companies to reimburse for certain expenses. Regardless of legality, most organizations do it anyway because it’s the fair thing to do.

- As a fringe benefit – Employers often give stipends or reimburse non-business-related costs as part of their total compensation plan. They might also use them as income for employees who go above and beyond, take on extra projects, or consistently exceed expectations. In both instances, stipends are intended to improve employee engagement and offset the costs of everyday life.

Examples of employee stipends

You can offer a monthly stipend for practically anything imaginable. Employers generally select the stipends according to the nature of their business activities and the interests of their employees.

A few of our favorite types of stipends include:

- Cell phone stipends

- Charitable giving stipends

- Equipment stipends

- Family stipends

- Health and wellness stipends

- Learning and development stipends

- Meal allowances

- Remote work stipends

- Student loan repayment assistance

- Travel stipends

For example, ButterflyMX uses Compt to offer its employees $300 self-care stipends each month, which they can use for anything that helps them take care of themselves — health and wellness, professional development, or even student loan repayment.

And tons of companies offer all kinds of stipends. For instance, UrbanSitter reports that 65% of their partner companies provide child care stipends, with the most common amount being $500 per year per employee.

Psst: To learn more about accounting for stipends on expense reports, read our guide on which fringe benefits are taxable and non-taxable.

Examples of reimbursements

Many employers use reimbursements to cover specific employee expenses. Most of the time, they only reimburse up to a specific amount, and employees must provide proof of purchase or other documentation before they can be reimbursed.

Examples of common employee reimbursements include:

- Business meals and entertainment

- Business tools, equipment, and software

- Business travel expenses

- Gym reimbursement

- Home office setup and equipment

- Mileage reimbursement

- Professional development costs (e.g., certifications, courses, conferences, and trade shows)

- Tuition reimbursement

- Uniforms and safety equipment

Some of these — like travel and software expenses — are a necessary part of running your business. But there are reasons to offer others as well — for instance, around half of companies offer undergrad and/or graduate tuition assistance, and tuition reimbursement program participants have proven to be 3-8% more likely to be retained than non-participating employees.

As an employer, setting up an expense reimbursement policy is in your best interest. This way, employees will know precisely what they need to do to be reimbursed for their expenses. It also protects your business from potential fraudulent expense reports and helps you comply with federal, state, and local tax codes.

Stipends vs. reimbursements: What’s the difference?

While stipends and reimbursements provide financial support to employees, the concepts aren’t exactly the same.

Let’s look at some key differences between the stipend and reimbursement model.

Amount

When we refer to stipends, we’re talking about a fixed amount of money given to an employee to help cover specific costs. It’s often given without the recipient needing to account for how they use the funds. It doesn’t necessarily have anything to do with expenses incurred, and there may not be rules for excess funds.

A stipend is an award given in its entirety.

With reimbursements, the amount reimbursed is contingent upon the actual expenses documented through receipts or invoices. Thus, the reimbursement amount equates to the sum total of all validated receipts or the maximum allowable award amount stipulated by the organization, whichever is less.

Timing

Stipends are usually processed promptly, meaning that individuals receive the full payment upfront. Recipients have the necessary funds to cover anticipated costs without wasting their money.

In that sense, stipends grant individuals financial freedom and planning autonomy from the outset, allowing them to budget and allocate funds best suited to their needs.

Reimbursement timelines are generally more drawn out. Here’s an example timeline:

- Employees spends their own money on the product, service, or operating expense.

- They submit a request for reimbursement, along with the appropriate receipts and other documentation.

- The company reviews the request and verifies it. This review process can take days or even weeks in some cases.

- They account for the expenses in their report.

- They issue a payment to cover the costs.

IRS Publication 463 states that expenses must be documented within a 60-day window and then paid within 30 days. However, employers sometimes miss out on valid reimbursements for business purposes due to lost receipts or failure to submit them

Receipt guidelines

For the most part, stipend recipients don’t need to provide any kind of proof or documentation to receive their payments. Instead, specific rules and statutes regulate those that aren’t considered taxable income.

For example:

- Commuter benefits can be withheld from income tax up to $300 per month.

- Student loan repayment assistance and tuition reimbursement are non-taxable up to $5,250 per employee per year.

- Per diem travel expenses are limited by your local per diem rate.

- Vehicle usage is expensive at the standard mileage rate of 65.5 per mile.

Reimbursement typically requires receipts and/or invoices for validation. These receipts should, at the very least, should include the vendor name, purchase/sale date, item/service purchased, and cost. Some expense types require additional information as well.

Tax implications

When it comes to taxes, stipends vs. reimbursements are quite different from one another.

- Tax forms – Depending on the recipient’s residency status in the US, you’ll have to report stipends using one of two tax forms. US citizens or resident aliens must complete a W-9 or W-2 form including these expenses, while non-resident aliens must complete a W-8BEN form. Reimbursements don’t require tax forms.

- Tax reporting – Stipends are taxable income unless they meet specific exceptions under IRS Publication 15-B. Reimbursements under an accountable plan aren’t subject to income, Social Security, or Medicare taxes. Those under non-accountable plans are.

Stipends and reimbursements aren’t mutually exclusive concepts (with Compt, at least).

In certain situations, employers may choose to offer a stipend and reimbursement combination, which we refer to as a stipend reimbursement.

1. The reimbursement model means employers don’t have to front the funds.

Employers benefit significantly from a reimbursement model for employee benefits as it alleviates the financial burden of upfront costs. Companies can efficiently manage cash flow without tying up large sums of money by allowing employees to pay for their benefits initially and then reimbursing them

2. Reimbursements are a ‘use it or lose it’ mechanism — you’re not paying for unused benefits.

Employers only need to reimburse for the amount the employee spends (versus offering a stipend set at an arbitrarily high amount).

Let’s say your company offers a fitness stipend of $150 per employee. When employees don’t use the full $150, you’re essentially leaving money on the table.

For these employee benefits, paying out what employees spend after the fact still makes more sense.

3. Employers can control spending without sacrificing employee autonomy and satisfaction.

The ‘stipend’ aspect of the reimbursement model means that employees can choose the vendors they want.

The direct benefits of this are:

- higher utilization rates (employers using Compt typically see 90% employee engagement)

- happier employees who receive personalized benefits

- inclusivity, especially for remote teams whose employees don’t all have access to the same set of vendors

This is particularly advantageous when offering health benefits, professional development stipends, or health and wellness perks that would be impossible to standardize for every employee’s needs.

Offer employees stipends with Compt for the best of both worlds

We make it simple to manage expenses and tax compliance through our platform. Our platform also integrates with your accounting system, so you can handle tax compliance, and finance teams don’t have to bear the burden of constantly tracking and reporting usage. With 25+ categories to choose from, the possibilities to customize stipend programs are truly endless. See for yourself.

Editor’s Note: Compt software supports the categorization and proper reporting of benefits according to IRS guidelines, helping businesses maintain compliance. However, Compt cannot provide tax advice, and users should consult their own tax, legal, and accounting advisors when necessary.

Additional Note: This post has been recently updated for clarity and relevance for our readers.