A staggering 4.7 million people (and counting!) work remotely at least half of the time in the United States alone. According to Owl Labs, 16% of companies globally are fully remote.

That is a lot of people working from home.

A lot of employees are powering up a personal workstation, logging on from a company-provided desktop or laptop, and answering a Slack message from their phones.

So it makes sense that there’s some gray area when it comes to what costs the employee is responsible for covering and what the company should pay for, especially when it comes to remote work perks like internet reimbursement and phone bills.

For remote-first and hybrid companies that may not want to ship a cell phone to every new employee, a stipend is a perfect solution to cover the cost of using personal cell phones for work calls. The right employee perks software can help disperse these funds and keep companies tax compliant – a huge plus for U.S.-based businesses with employees in the states and overseas.

Has your team asked for this stipend in your recent employee benefits survey? How do you know if a cell phone stipend is the right solution for your business? Read on to find out.

What is A Cell Phone Reimbursement Stipend?

We keep referring to it as a cell phone reimbursement stipend, but you may be more familiar with the term “cell phone allowance.” Either way, we’re talking about a sum of money a company gives to its employees in order to purchase cell phone plans or pay their cell phone bills.

Typically, these stipends are distributed monthly (thus covering the monthly bill!). According to LinkedIn, many companies opt to provide employees an average of $36 each month for cell phone stipends. For an annual budget, that works out to about $430 each year per employee.

And while it could be seen as additional employee compensation, if you’re wondering “are cell phone allowances taxable?” the answer is no. Cell phone stipends are a non-taxable benefit, according to the IRS, which is great news for both your company and your employees.

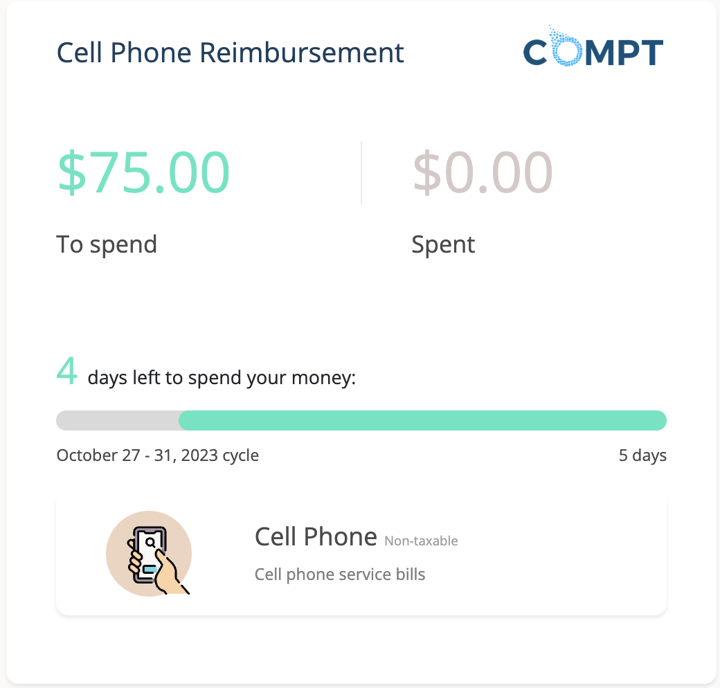

Example of a Cell Phone Stipend

When to Reimburse Employees for Cell Phone Use

The key is to properly discern when to reimburse employees for cell phone use, and there are some clear guidelines to follow. It’s appropriate to do so when team members use personal phones to:

- Make work calls

- Check and respond to email

- Post updates in work-specific accounts and apps

- Message coworkers via Slack, Microsoft Teams, or other internal chat systems

Why You Should Set Up A Cell Phone Stipend

Depending on which state you’re in, it could be required that you cover the cost of personal cell phone use for work matters. For instance, employers must reimburse California employees even if that person does not actually incur additional expenses due to personal cell phone use.

Aside from requirements, there are clear benefits to offering a cell phone stipend:

- It’s non-taxable which is good news for your employees and finance team.

- When distributed through an expense or perk management software like Compt, the best employee benefits are scalable, meaning eased administrative burden on your HR teams. Plus, with Compt, you can stay 100% IRS compliant without having to lift a finger.

- It helps add clarity to what additional, non-traditional benefits your company covers, which is helpful in both recruiting and retention efforts.

What Is the Difference Between A Cell Phone Stipend and A Work Equipment Stipend?

In today’s remote world, many people are not only using their personal cell phones to get work done, but they’re also spending money on other work-related expenses, especially if they have work from home costs like setting up a home office. Purchasing noise-canceling headphones, ergonomic chairs, computer monitors, etc. can get expensive. And that’s all before the monthly internet bill arrives.

Many employee-first companies, whether fully remote or hybrid, are going beyond a traditional cell phone allowance and throwing in extra cash to support employees like with a work equipment stipend.

With a more expansive stipend - one that covers all the tools remote employees need to be productive at home - companies are able to cover the same amount of money for employees but give them more options and control over what they want and need to spend their stipend on. If you're looking for employee engagement ideas for remote workers, personalizing employee perks is proven to see higher utilization and engagement.

How to Offer A Cell Phone Stipend: Step by Step

- Determine how much you want to offer your team and in what time frame. Will your stipend be monthly, quarterly, annually, or a one-time remote work stipend or equipment stipend? When you give employees a specific amount every month, you can reimburse them through expense software. (With Compt, this is especially easy because the software integrates with the popular expense tools HR teams rely on.)

- Select your perk spending categories. Do you want to offer just a “Cell Phone Perk Stipend” or will you consider offering a “Work Equipment Stipend” or maybe a “Productivity and Tech Stipend”? Keep in mind that a cell phone exclusive stipend will be nontaxable and a work equipment allowance will include some taxable items like a computer monitor.

- Once you have the basics above decided, it’s time to decide how you’ll manage the process.

- With your program in place, what methods do you use to ensure you are communicating effectively with a remote team? It's important employees know how to take advantage of their new benefit.

Cell phones have undoubtedly become more essential in everyday work. When planning to reimburse employees or implement a stipend program to cover phone expenses, it is crucial to meet IRS guidelines. We recommend using Compt (obviously) to ease the administrative burden on your HR team, make accounting and IRS compliance simple for your finance team, and make reimbursement fast and easy for employees.

For more resources, we recommend checking out our favorite HR podcasts or subscribing to our HR newsletter, People First. Or check out these employee benefits statistics.