Offering lifestyle benefits is one of the best ways to strike a balance between your team members' work and personal life while increasing employee satisfaction and retention and differentiating your company from others.

Compared to other regions of the country, the Midwest is a unique case. In addition to having the slowest wage growth in the nation, Midwestern companies have the lowest yearly budgets for employees' lifestyle spending accounts (LSAs), on average. The lifestyle benefits budget gap between the Midwest and the Northeast, for example, exceeds $1,000.

Benefits remain a critical deciding factor for top talent, which raises a pressing issue in today's hybrid work environment: how can Midwestern employers constrained by tight budgets compete with stronger economic regions for highly skilled workers?

Our Lifestyle Benefits Benchmarking Midwest Report reveals six emerging trends in 2024.

1. Food and personal focus benefits are employees' top priorities.

By both employee claims submitted through Compt and overall budget allocation, the "Treat Yourself" and "Food" categories accounted for over 50% of all lifestyle benefit spending.

The “Treat Yourself” category covers a wide range of eligible expenses, including dining out, spa treatments, gym memberships and anything else employees may consider as "me time."

While categories like health and wellness and family stipends are incredibly important, this finding underscores the fact that employees value personalization and flexibility over standardized benefits.

Key takeaway: Differentiate your company culture and benefits package by adding a personal touch. Connect with your employees through a small, but meaningful stipend budget for personal expenses.

2. High budget ≠ high utilization. Personalization does.

All-inclusive packages beat out à la carte stipends (by a huge margin).

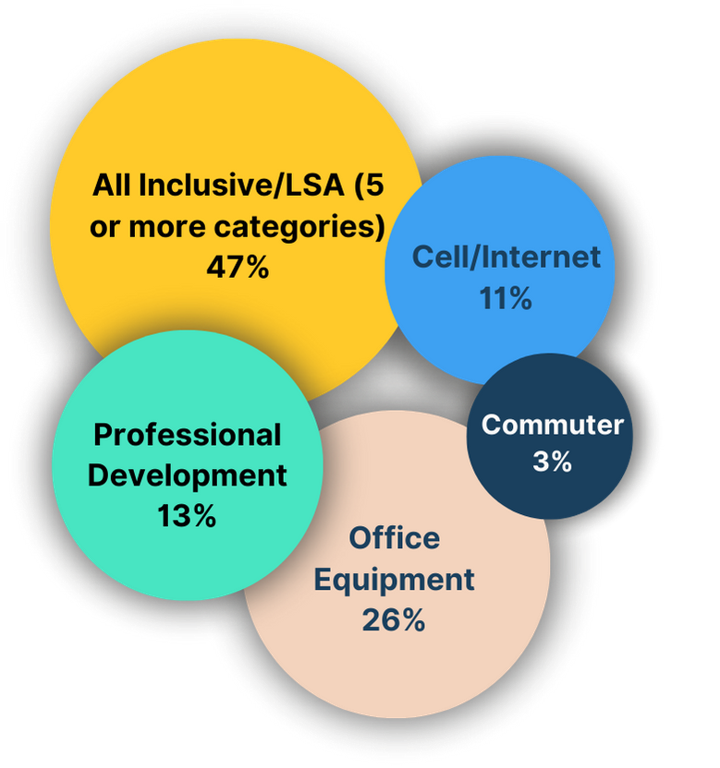

LSAs and other forms of all-inclusive lifestyle benefits packages with 5+ benefits categories are the dominating company offerings in the Midwest, with 47% of employers opting for this model.

At Compt, we believe in inclusivity and full employee autonomy. While other top categories like office equipment, cell phone and internet, and professional development are undoubtedly attractive to some team members and job seekers, grouping five or more categories into one is more inclusive for everyone on the team.

You can appeal to top talent on a limited budget by providing options for multiple benefits they'll actually use. This is especially true for stipend categories like caregiving and financial wellness, which statistically have the highest average claim values but will only appeal to a select group of employees.

Key takeaway: Get the most out of your limited stipend budget by offering all-inclusive packages with 5+ benefit categories. This maximizes utilization and guarantees a positive impact on your team.

3. Return to office initiatives and inflation are shifting employees away from non-taxable benefits.

While non-taxable benefits like home office equipment subsidies were previously some of the most important to employees, companies in the Midwest collectively saw 91% of benefits claims in 2023 going towards taxable benefits.

There are a few potential reasons for this:

- Return-to-office initiatives are becoming more common, and employees are starting to prioritize benefits that have a direct impact on their daily work-life balance.

- Inflation and rising costs of living are forcing employees to prioritize cash-like benefits that they can put towards essential expenses (e.g., food, health and wellness).

Key takeaway: As you shift your work model, adapt to evolving trends, and grow your team, keep an eye on their changing priorities and adjust your benefits accordingly.

4. Rigid benefits from name brands are becoming a thing of the past.

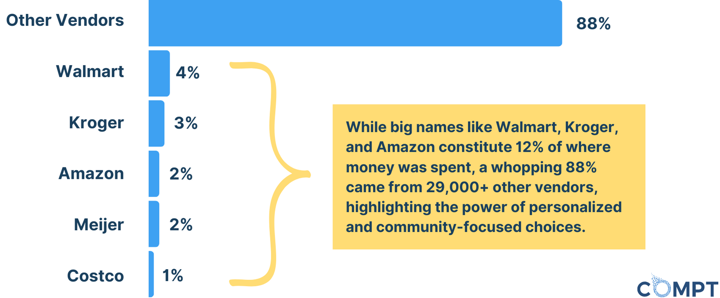

While some companies might feel inclined to offer benefits like a free gym membership to 24-Hour Fitness or $100 Amazon credit per month, these only include people who live near a location or actually like shopping at these places.

According to our data from benefits claims across our Midwestern customers, large retailers collectively account for just 12% of all claims. Take a look at how the collective diversity of 29,000+ “other vendors” (e.g., your local coffee shop or a community organization) trumps benefits partnerships with even the most popular major retailers.

As a tangible, real-life example: a large social networking company used Compt to revamp its lifestyle benefits. They replaced gym memberships with a wellness stipend they could use anywhere in the world.

By making the benefit more inclusive, they were able to achieve 90% utilization among 700+ employees across 8 countries, dramatically increasing its impact.

Key takeaway: By promoting flexible stipends and reimbursements to top talent, your organization is more attractive compared to companies with larger budgets that are locked into partnerships with specific vendors.

5. Smaller companies focus on benefits whereas larger ones pay higher salaries.

How your company approaches lifestyle benefits as a proportion of total comp might differ depending on its headcount.

According to our data:

- Companies with less than 100 team members spend the most per employee per year, on average.

- Those with more than 1,000 employees spend less than half of what companies with less than 100 employees do per employee per year.

That's not to say larger companies don't care about lifestyle benefits. In fact, many of them use Compt to offer personalized stipends and reimbursements focusing on a wider variety of ad hoc benefits and point solutions.

Key takeaway: Consider the size of your company and how similar-sized competitors differentiate when figuring out the optimal approach to benefits and salary levels.

5. Smaller companies focus more heavily on benefits.

How your company approaches lifestyle benefits as a proportion of total comp might differ depending on its headcount.

According to our data:

- Companies with less than 100 team members spend the most per employee per year, on average.

- Those with more than 1,000 employees spend less than half of what companies with less than 100 employees do per employee per year.

That's not to say larger companies don't care about lifestyle benefits. In fact, many of them use Compt to offer personalized stipends and reimbursements focusing on a wider variety of ad hoc benefits and point solutions.

Key takeaway: Consider the size of your company and how similar-sized competitors differentiate when figuring out the optimal approach to benefits and salary levels.

6. The benefits gap closes as companies grow larger.

Interestingly, our abovementioned data also shows that the benefits gap we've talked so much about practically disappears once you reach the "more than 1,000 employees" threshold.

While companies in the rest of the US spend double or more per employee per year on lifestyle benefits:

- Midwestern companies with 1,000+ employees spend $633 per employee per year.

- Across the US, companies with 1,000+ employees spend $647 per employee per year.

This puts Midwest companies nearly on par with their larger counterparts across the US.

Key takeaway: If you're a large company, first consider the competitiveness of your base pay. If you're aligned with other companies nationwide, use this opportunity to differentiate by offering more extensive and personalized lifestyle benefits.

What 2024 holds for lifestyle benefits in the Midwest

While there are certainly regional differences when it comes to company benefits, the overarching takeaway is that employees value a diverse range of options, even more than specific dollar amounts. This is your key to differentiation against companies in other regions with larger budgets.

When launching your program, broker relationships are key. Those who work with a broker to implement a stipend program through benefits software have a 20.4% higher utilization rate. At Compt, we work with benefits brokers and consultants to create personalized stipend programs for their clients, helping them attract and retain top talent.

Download the full report for the most comprehensive insights.