If your employees aren't satisfied with their current benefits package (or worse, they don't use it at all), that doesn't necessarily mean the benefits themselves aren't good enough.

More often than not, they're just too rigid for most of your team to get real value out of them.

You're already putting tons of time and money into your benefits package. Personalization, flexibility, and inclusivity are what guarantee an ROI.

What are flexible benefits?

Flexible benefits are employee benefits that are structured in a way that allows employees to choose what best suits their needs, rather than being offered a one-size-fits-all package. They include traditional benefits like health insurance, retirement plans, and paid time off, but also offer a variety of additional options like lifestyle stipends.

The idea behind flexible benefits is simple: By choosing benefits vendors and offering perks with more options and wiggle room for customization, you're able to offer a more diverse and valuable package that caters to the unique needs of each member of your workforce.

Rigidity is killing your benefits package.

Data from MetLife finds that less than two-thirds (61%) of employees were satisfied with their company's benefits package in 2023. That's the lowest it's been in a decade.

But why?

There are dozens of reasons any one employee might be dissatisfied with what their company offers, but they all reach one common denominator: a lack of personalization.

Whether your employees think you aren't offering enough benefits, or that your perks aren't the right ones for them specifically, what they're really saying is: "You're out of touch with what I need."

You need to prioritize flexibility when building your benefits plan.

It's actually the most important element of your employee benefits strategy. There are several advantages to offering a flexible benefits package, including:

Flexible benefits are inclusive.

They allow everyone the control to use them in a way that works best for their individual needs and circumstances, rather than forcing them to fit into a one-size-fits-all mold.

For example, when it comes to employee wellness, some employees are part of a running club, some do yoga, others prefer meditation apps.

With flexible benefits, your employees can choose for themselves.

They're remote-friendly.

Vendors differ geographically. To ensure equal access to benefits for remote employees, it's crucial to offer flexible options that can be utilized wherever they are.

Let's say you pay for employees' Planet Fitness memberships as a wellness benefit. While this is a great perk for team members who live within walking distance of one, it does absolutely nothing for those who don't.

Instead, you could offer gym membership reimbursement, which enables all your employees to sign up at the gym of their choice, whether they're in Manhattan or a small Midwestern town.

They allow for life changes.

Employees' needs, interests, and circumstances change over time. Flexible benefits can be easily adjusted to accommodate these changes, making them an attractive long-term option.

Suppose you cover mass transit costs as part of your commuter benefits package. One of your employees has used the train to get to work every day for years, but they finally saved up and bought a car. Now, they need to pay for parking every day, which you have a completely different process for managing.

Offering benefits through a stipend would be far more effective here. They could use the exact same payment for any commuting costs, and your software would handle the expense management automatically.

Employees have an easier time understanding them.

MetLife's 2023 Employee Benefits Trends survey found that half of employees feel most benefits communication isn't relevant to them, and 63% want more personalized recommendations. When they don't understand what they're enrolling in, they're less likely to.

With flexible benefits, your HR team can tailor suggestions to each employee's needs. As a result, benefits enrollment increases.

They're cost-effective.

By allowing employees to choose what's most meaningful to them, you can avoid spending money on benefits that may go unused or underappreciated. You'll also see a reduction in admin costs, since your HR team won't need to spend as much time explaining benefits packages or dealing with administration for dozens of different types of one-off benefits.

They increase employee satisfaction and retention.

Flexibility is what drives up employee participation in your program (and, by extension, engagement and productivity in the workplace). It's also what drives down turnover, since your employees feel like you're actually invested in their health and well-being.

Since more than half (57%) of all jobseekers put employee benefits at the top of their priority list and 80% prefer better benefits to a pay raise, investing in personalization also increases employee recruitment success.

Examples of flexible benefits

Most flexible benefits work on a stipend, reimbursement, or stipend reimbursement model (see our article on stipends vs. reimbursements).

Essentially, employees get a set amount of money to use on their benefits each month or year. How they spend it is up to them.

You can also make your standard employee benefits like healthcare and retirement more flexible by offering multiple options within each category.

Let's dive in.

Health benefits

Group health plans are the most popular choice for U.S. employers. They're not flexible at all for diverse workforces, though. And they're constantly getting more and more expensive.

There are plenty of options that let employees control their own healthcare more without going above your budget.

- Health reimbursement arrangement (HRA) — Employees can use their account balance to reimburse themselves for qualified medical expenses (and sometimes insurance premiums). Some limit contributions to $2,100, but not all, which makes them flexible enough for all your employees' needs. Plus, unused allowances stay with the employer.

- Health savings account (HSA) — This option is similar to an HRA, except it's funded pre-tax by both the employer and employee. It must be used in conjunction with a high-deductible health plan (HDHP). Contribution is limited to $4,150 for single employees and $8,300 for families, and funds roll over to the next year.

- Flexible spending account (FSA) — Employees make pre-tax contributions (up to $3,200 per year) to flexible spending accounts, which they can use for medical expenses not covered by insurance.

- Dental and vision benefits — Employees can choose from various levels of coverage and plans that best suit their needs. Group plans don't normally cover it, so this is a great way to extend the flexibility of your benefits package.

Stipends

A stipend is a fixed amount of money employees can spend on their benefits. Employers set the amount using stipend software and disburse it through payroll.

Examples include:

- Work-from-home allowances (for employees who are not working remotely full-time)

- Internet, cell phone, and equipment stipends (to cover work-related expenses)

- Commuting benefits (for employees who need to commute for work)

- Health and wellness stipends (to spend on gym memberships, fitness classes, meditation apps, etc.)

- Family stipends (to help with family planning, childcare, and other expenses)

- Professional development stipends (for employees looking to further their education, get certifications, or attend conferences)

The wonderful thing about stipends is your team has complete control over how they use them.

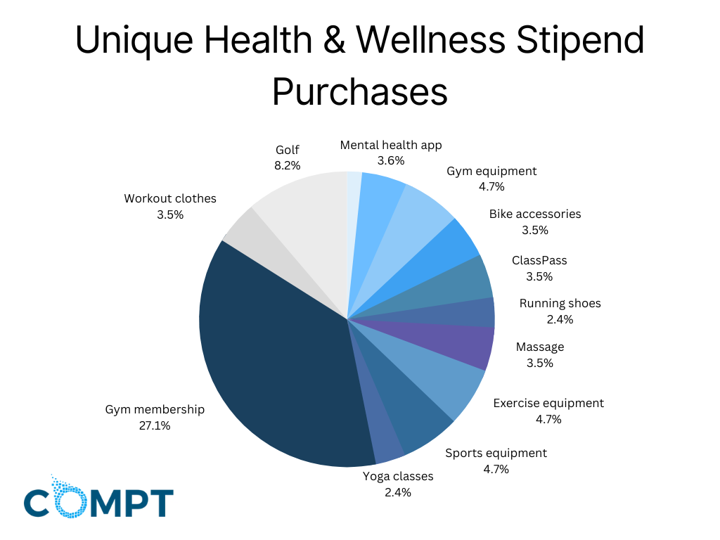

As an example, Webflow uses Compt to offer health and wellness stipends. While close to one-third of their team members use it to cover their gym membership fees, plenty of them use it for things like yoga classes, workout clothes, and home equipment.

The point is: EVERY employee associates your benefits plan with something that THEY need, and you didn't have to do any extra work.

Actually, you did less work.

Reimbursements

Some employee perks are better as reimbursements. When the cost of something is variable or the benefit applies to fewer of your team members, reimbursements are the better option.

For instance:

- Home office setups (multiple pieces of equipment need to be purchased and assembled)

- A one-off lunch or meal (for example, for a busy day of meetings or just as a reward)

- Professional association fees (not all employees are members of professional organizations)

- Training courses and certifications (only employees who want to take them will do so)

Offering reimbursement perks also gives your HR and finance team the opportunity to screen for eligible expenses.

This is an important distinction when offering taxable vs. non-taxable benefits — e.g., gym reimbursement isn't tax-deductible, but certain home office purchases and training certifications are.

Unlimited PTO and floating holidays

Paid time off is a standard employee benefit, but offering it in a more flexible way can make your company stand out. Unlimited PTO means employees are free to take as much time off as they need, within reason.

While we take holidays like Christmas and Thanksgiving off, some of your employees will celebrate other holidays. To accommodate, offer floating holidays that employees can use for their preferred days off.

That way, your team can celebrate their religious and cultural traditions without having to use vacation time.

Flexible scheduling

Where the situation allows, employees will never complain about the ability to work how they want or when they want, at least some of the time.

Depending on the nature of the work and office setup, you could offer a variety of options to help employees manage their work schedule and personal life.

- Remote work or telecommuting (at least on certain days of the week)

- Flexible start and end times (employees have meetings or deadlines, but can otherwise set their own schedule)

- Job sharing or job splitting (two employees share the same role with different days and hours of work)

In a McKinsey survey, 94% of respondents said they'd benefit from more flexibility. If it's possible for your company, do it.

How to go from "benefit" to "flexible benefit"

Believe it or not, the difference between an inclusive and versatile benefits package and a rigid one is just a little bit of strategy.

The changes that take your benefits plan from mediocre to top-tier and flexible for everyone are more about how you choose your benefits categories, vendors, and how you use technology.

And they're pretty easy to implement, too.

- Run an employee benefits survey. Use the results to evaluate your current package and determine which benefits your team cares about the most.

- Consider your company culture and core values. A pet care stipend would go over well if you have a lot of pet owners in your team or operate in the pet industry. If your employees don't care about it, it'll be a waste.

- Look at your health benefits first. They're the ones that matter most. For instance, look for plans that cover domestic partners to include LGBTQ+ families and support those who prefer not to get married.

- Go after low-hanging fruit. A few quick policy changes can make your whole benefits package more flexible. Offer paid maternity leave? Change that to paid parental leave so anyone can use it.

Compt's employee stipend software streamlines everything you need to make your benefits more flexible — enrollment, stipends, reimbursements, expense management, reporting, and tax compliance. That's why our customers see ~90% engagement from their teams when they use us to offer lifestyle benefits.

Request a demo to see how it works.